Creating a wealth corner tailored to your personal goals

Understanding Your Current Financial Situation

Before setting financial goals, it's crucial to understand your current financial position. This includes evaluating your income, expenses, savings, debts, and assets. Taking stock of your current financial health is essential to developing realistic and achievable goals. A thorough assessment will provide a clear picture of where you stand and inform the strategies needed to move forward.

Analyzing your income and expenses, including fixed costs like rent or mortgage and variable costs like entertainment, is vital for this assessment. A budget is a powerful tool that can help you track these expenses and uncover areas where you can potentially reduce spending.

Setting Realistic and Measurable Goals

Financial objectives should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Simply wanting more money is too vague. Instead, aim for a specific amount of savings in a defined time frame. For instance, save $5,000 in the next 12 months is much more effective than save money. This clear definition helps you stay focused and track your progress.

Measurable goals provide a clear benchmark for success. Establishing clear milestones ensures you are aware of your progress along the way and allows for adjustments if needed.

Short-Term vs. Long-Term Goals

Defining short-term and long-term financial objectives is important for effective financial planning. Short-term goals, such as saving for a down payment on a car or paying off high-interest debt, can be achieved relatively quickly. These smaller milestones can be incredibly motivating, building confidence and momentum toward larger financial goals.

Long-term financial objectives, like retirement planning or funding your children's education, require a longer timeframe and often more complex strategies. By considering both short- and long-term goals you can build a comprehensive financial plan that encompasses your present and future needs.

Prioritizing Financial Objectives

Not all financial goals are created equal. Some may be more critical or urgent than others. Prioritize your goals based on their importance and urgency. For instance, paying off high-interest debt is often a higher priority than saving for a vacation.

Determining which goals are most important and urgent will help you to focus your resources effectively. A well-organized list of priorities can make a significant difference in the overall success of your financial planning.

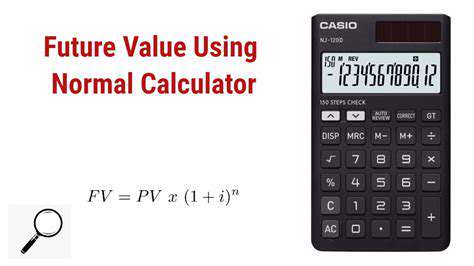

Developing a Financial Action Plan

A financial action plan is a roadmap to achieving your financial objectives. It outlines specific steps, timelines, and resources needed to accomplish each goal. This plan should be detailed and practical. It should include timelines for each objective and a realistic assessment of the resources needed.

The plan must be reviewed and adjusted regularly. Your circumstances and goals will change over time, so it's essential to stay adaptable. Consider adding contingency measures and strategies to address potential setbacks. Regular review ensures that your plan remains relevant and effective as your financial situation evolves.

Tracking Progress and Making Adjustments

Monitoring your progress toward your financial objectives is essential for staying on track. Regular reviews allow you to assess your performance and identify any areas where you may need to adjust your approach. This might mean cutting unnecessary expenses, increasing your savings rate, or changing your investment strategy.

Adaptability is crucial in financial planning. Life throws curveballs, and your circumstances may change. Adjust your plan as needed to account for unforeseen events or shifts in your priorities. Tracking your progress and staying adaptable ensures you remain on course towards your financial goals.

Establishing a Regular Review Schedule: Maintaining Momentum

Prioritizing Consistency for Steady Growth

Establishing a consistent review schedule is crucial for maintaining momentum in your wealth-building journey. Regular reviews, whether weekly, monthly, or quarterly, act as checkpoints to track progress, identify areas for improvement, and ensure your investment strategies remain aligned with your financial goals. Consistent monitoring allows you to react to market fluctuations and make necessary adjustments to maximize returns and minimize risks, ensuring your wealth-building efforts are on the right track. This proactive approach is far more effective than waiting for major setbacks to address critical issues.

The key is not just the frequency, but also the thoroughness of the review process. Detailed analysis of your current financial situation, including your income, expenses, investments, and debt levels, provides a clear picture of your overall financial health. This comprehensive understanding enables informed decisions and strategic adjustments, allowing you to stay adaptable to the dynamic nature of the market and your personal circumstances. Reviewing your financial goals and milestones at regular intervals also ensures you remain focused on your aspirations and can make timely adjustments to stay on target.

Adapting Your Strategy Based on Feedback

A robust review process should always be paired with a willingness to adapt your strategies. Market conditions change, your personal circumstances evolve, and new opportunities arise. Regular reviews allow you to evaluate the effectiveness of your current approach and make necessary adjustments. This adaptability is paramount for long-term wealth building. By consistently monitoring and analyzing your investments, you can spot emerging trends and potentially capitalize on lucrative opportunities while avoiding potentially detrimental shifts.

Furthermore, reviewing your progress against your financial goals provides valuable insights into any areas requiring more attention or resources. Identifying and addressing these challenges early can save you significant time and potentially substantial losses down the road. By staying proactive, you can cultivate a mindset of continuous improvement in your wealth-building endeavors and stay on the path toward achieving your financial aspirations.

Regular review sessions will help you identify any blind spots or weaknesses in your current investment strategy. You can identify potential roadblocks, implement preventive measures to minimize risks, and ensure that your overall approach remains aligned with your goals. This constant cycle of assessment and adjustment is vital to sustained financial growth and success.

Regular reviews allow for a deeper understanding of your portfolio's performance and alignment with your financial objectives. A proactive approach fosters a greater degree of control over your financial future, empowering you to make informed choices that support your wealth-building strategy.