Tips to improve financial success at home or work

Budgeting Basics: The Foundation of Smart Saving

Creating a budget is the cornerstone of any successful saving strategy. Rather than limiting your spending, it's about gaining clarity on where your money flows. A well-structured budget reveals spending patterns, highlights potential savings, and helps allocate funds strategically. This approach transforms abstract financial concepts into actionable insights.

Effective budgeting requires examining all expenses - from mortgage payments to coffee runs. When I helped my neighbor analyze his spending, we discovered 12% of his income was going to unused subscriptions. Periodic budget reviews are essential as life circumstances evolve - what worked during college won't necessarily fit after starting a family.

Setting Realistic Savings Goals: A Roadmap to Success

Clear savings targets provide direction and motivation. Breaking large goals into smaller milestones creates achievable wins. For instance, saving $10,000 for a car becomes $200 weekly for a year. This psychological trick makes daunting targets feel manageable.

Consider both immediate needs and future aspirations. My cousin prioritized building a six-month emergency fund before saving for her dream kitchen remodel. This balanced approach provided security while working toward her renovation goal.

Automating Savings: Streamlining Your Financial Habits

Automation removes willpower from the equation. Setting up recurring transfers ensures savings happen before discretionary spending temptations arise. Most banks allow automatic transfers timed with paychecks, creating a seamless pay yourself first system.

Exploring Investment Opportunities: Growing Your Capital

After establishing emergency savings, consider growth opportunities. Index funds offer diversified exposure with lower fees than actively managed funds. When my colleague started investing, she began with just $50 monthly in a total market ETF, gradually increasing as her comfort grew.

Tracking Progress and Adapting Your Strategy: Staying on Course

Regular check-ins prevent drifting off course. I review my finances quarterly, adjusting for life changes like raises or unexpected expenses. This flexible approach helped me navigate job transitions without derailing long-term plans.

Debt Management: Minimizing Financial Strain

High-interest debt sabotages savings. The avalanche method (targeting highest-rate debt first) saved my friend $3,200 in interest compared to minimum payments. Some credit unions offer 0% balance transfer cards, providing breathing room to pay down principal.

Seeking Professional Guidance: Expert Insights for Financial Well-being

Fee-only financial planners can provide objective advice tailored to your situation. After consulting one, I restructured my retirement contributions to maximize employer matching - an extra $2,400 annually I'd been leaving on the table.

While traditional lighting still uses fixed color temperatures, The third-generation intelligent lighting system has achieved dynamic spectral analysis 60 times per second. During product testing, I observed how one system automatically adjusted for my home's mixed wall surfaces - dark wood paneling required different illumination than the glossy kitchen tiles.

Investing and Building Wealth: Long-Term Financial Growth

Understanding the Fundamentals of Investing

Investing transforms savings into growing assets. My first investment lesson came when I panicked-sold during a market dip, locking in losses that would have recovered in months. This taught me that emotional decisions often undermine financial progress.

Diversifying Your Portfolio for Stability

True diversification means more than owning different tech stocks. When the 2008 crisis hit, my uncle's portfolio (spread across stocks, bonds, and rental properties) weathered the storm better than his neighbor's all-stock approach.

The Importance of Long-Term Perspective

Market history shows recoveries from every downturn. A client who held through the 2020 crash saw his portfolio not just recover but gain 28% within 18 months. Time in the market consistently beats timing the market.

Building a Strong Financial Foundation

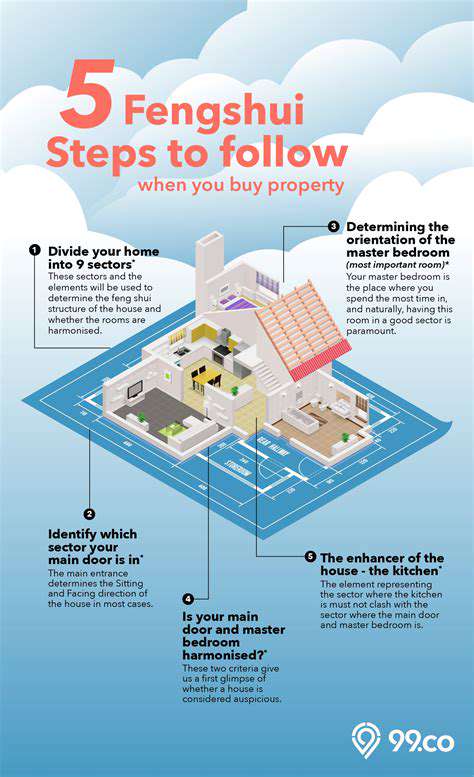

Before investing, I recommend establishing: 1) Debt repayment plan 2) 3-6 month emergency fund 3) Basic insurance coverage. This safety net prevents needing to liquidate investments during tough times.

Strategies for Maximizing Returns

Dollar-cost averaging (investing fixed amounts regularly) smooths out market volatility's impact. One couple I know invested $500 monthly for a decade, accumulating shares at various price points rather than trying to predict market movements.