Feng Shui for Budgeting: Attracting Financial Discipline

Developing mindful spending habits involves taking a conscious and intentional approach to how you spend your money. This means recognizing your spending triggers, understanding your financial goals, and aligning your spending with those goals. Taking the time to analyze your spending patterns is crucial for identifying areas where you might be overspending or making unnecessary purchases.

A crucial part of this process is identifying your spending patterns. Do you find yourself impulsively purchasing items? Are there certain stores or websites that tempt you to spend more than you intend? By understanding these patterns, you can start to develop strategies to manage them effectively.

The Role of Financial Goals in Mindful Spending

Clearly defined financial goals provide a roadmap for your spending decisions. Whether it's saving for a down payment on a house, paying off debt, or building an emergency fund, having specific goals helps you prioritize your spending and make choices that align with your long-term financial objectives. This focus on the future prevents impulsive spending that might derail your financial plans.

Without clear financial goals, it's easy to get caught in a cycle of spending without a clear purpose. Mindful spending, in contrast, directs your spending towards achieving something specific, increasing the probability of reaching your financial objectives.

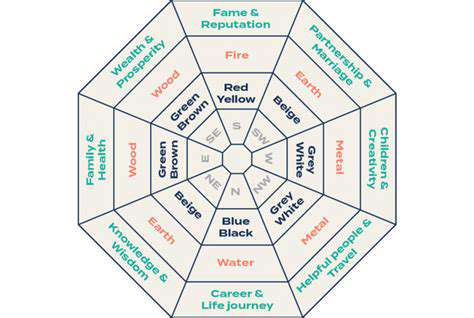

Feng Shui Principles and Your Finances

Feng Shui, an ancient Chinese practice, suggests that the arrangement of your surroundings can significantly impact your energy flow, including your financial well-being. By strategically arranging your home or office space, you can create an environment that fosters abundance and prosperity.

This holistic approach to finances goes beyond simply budgeting. It considers the emotional and energetic aspects of your financial life, suggesting that a harmonious environment can positively influence your financial outlook and decisions. By practicing Feng Shui principles, you can foster a more positive mindset towards money and abundance.

Budgeting and Tracking Your Spending

Creating and consistently adhering to a budget is a fundamental aspect of mindful spending. A budget allows you to track your income and expenses, enabling you to see where your money is going and identify areas for potential savings.

Tracking your spending, whether using a budgeting app or a simple spreadsheet, provides valuable insights into your spending habits. Regular review of your spending patterns allows you to adjust your budget and make necessary changes to align with your financial goals.

Mindful Shopping Practices

Becoming a more conscious shopper involves approaching purchases with intention and awareness. Consider the need for an item before making a purchase; ask yourself if it aligns with your financial goals and if it genuinely brings you value. By questioning your needs before buying, you can avoid impulsive purchases and unnecessary spending.

Taking the time to compare prices, read reviews, and consider alternative options can often lead to more informed purchasing decisions, helping to avoid impulse purchases and overspending. This mindful approach to shopping promotes more responsible financial choices.

Emotional Spending Triggers and How to Manage Them

Emotional spending triggers can significantly impact your financial well-being. Stress, boredom, or even feelings of happiness can lead to spending decisions that aren't aligned with your financial goals. Recognizing these triggers is the first step to managing them.

Developing coping mechanisms for these emotional triggers is crucial. This could involve finding alternative ways to manage stress, seeking support when necessary, or engaging in activities that bring you joy without requiring financial expenditure.

The Importance of Saving and Investing

Saving and investing are integral components of mindful spending. It allows you to build a financial safety net, providing security and stability during unexpected life events. Saving a portion of your income is a powerful tool for achieving financial freedom.

Investing wisely, while not a guaranteed approach, can help your money grow over time, allowing it to work for you and further supporting your long-term financial goals. It's essential to research and understand investment options before making any decisions.