Key factors to consider when selecting a new home

Contents

Selecting an ideal location shapes both daily contentment and long-term equity growth.

Neighborhood security checks are non-negotiable during property evaluations.

Nearby facilities drastically improve convenience and life satisfaction.

Local social vibes determine how well you'll integrate into the area.

Tracking housing market patterns provides critical investment foresight.

Accurate spatial assessments prevent future layout frustrations.

Thoughtful floor designs optimize functionality and personal enjoyment.

Private outdoor areas boost mental health and property worth.

Anticipating growth needs prevents costly relocations down the line.

Neighbor interactions directly affect residential satisfaction levels.

Building integrity dictates ownership expenses and appreciation potential.

Historic properties offer character but demand vigilant upkeep.

Professional inspections expose hidden structural concerns effectively.

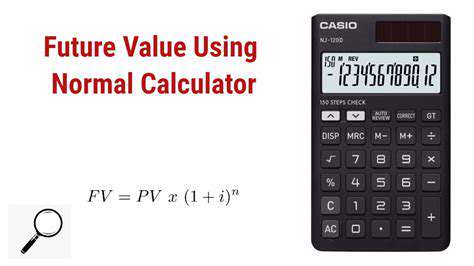

True affordability extends far beyond initial purchase figures.

Mortgage variations cater to diverse financial situations.

Credit health opens doors to favorable loan conditions.

Property ownership serves as cornerstone for wealth accumulation.

Regional developments dramatically sway valuation trajectories.

Sought-after districts consistently outperform market averages.

Modern upgrades substantially enhance buyer appeal at resale.

Geographic positioning remains the prime value driver in realty.

Proactive maintenance preserves asset worth across decades.

1. Location and Neighborhood Dynamics

Decoding Geographic Significance

Your home's coordinates influence everything from morning commutes to weekend routines. I've watched clients transform their lives simply by reducing daily drive times - one family reclaimed 10 hours weekly by moving closer to their children's school. Essential services within walking distance aren't just convenient; they create spontaneous community connections that appraisers can't quantify.

Safety Evaluation Tactics

While crime stats provide baseline data, true security understanding requires boots-on-ground research. Try this: visit local coffee shops at 7 AM and bars at 10 PM. You'll witness the neighborhood's true character. Neighborhood Safety isn't just about low crime rates - it's about street lighting quality, neighborly vigilance, and even dog walker frequency.

Lifestyle Infrastructure Access

Proximity to healthcare facilities becomes crucial during emergencies - a lesson learned when my cousin waited 38 minutes for an ambulance in a poorly serviced suburb. Don't just map existing amenities; investigate municipal development plans. That empty lot might become a supermarket...or a landfill.

Cultural Compatibility Checks

Attend a local community board meeting before buying. You'll quickly sense whether your values align with residents'. I'll never forget the investor who purchased a beachfront condo without realizing the community banned short-term rentals - his income property became a financial anchor.

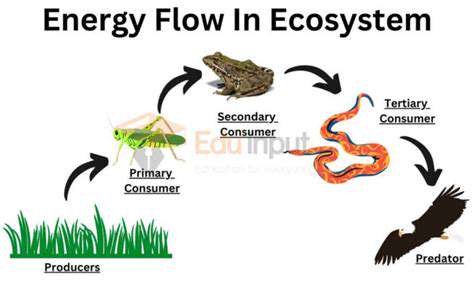

Market Movement Analysis

Savvy buyers track infrastructure projects like railway expansions or new hospitals. Real estate market trends often hinge on these developments. Last year, homeowners along the proposed greenbelt trail saw 22% appreciation before construction even began.

2. Spatial Design Considerations

Personal Space Requirements

The pandemic reshaped spatial needs dramatically. Many regret overlooking home office potential - I've seen countless dining tables permanently converted to workstations. For growing families, consider convertible spaces that adapt to life's changes.

Flow Optimization Strategies

Observe how sunlight moves through rooms during different times. A client once bought a south-facing kitchen that became unusable in summer afternoons. Smart layouts balance privacy and connectivity - think soundproofed bedrooms near open living areas.

Exterior Space Utilization

Outdoor Space proved invaluable during lockdowns. One creative couple transformed their balcony into a micro-farm, growing 30% of their vegetables. Remember: outdoor maintenance costs can offset value gains - that picturesque koi pond might deter time-strapped buyers later.

Adaptable Design Features

Look for bonus spaces with conversion potential. An attic with proper ventilation could become a studio, while an unfinished basement offers storage solutions. Always verify local zoning laws - some areas prohibit garage conversions despite housing shortages.

3. Structural Integrity Assessment

Building Health Diagnostics

Request utility bills from previous owners - they reveal hidden issues better than any inspection. A charming Victorian might cost $500 monthly to heat due to poor insulation. Always check flood zone maps, even for inland properties - climate change has rewritten risk assessments.

Age-Related Considerations

Pre-war craftsmanship often surpasses modern quick-build homes, but lead paint and asbestos require mitigation. New constructions aren't immune to defects - the 2022 drywall shortage led to problematic installations in many developments.

Professional Evaluation Necessity

Never skip sewer line inspections. I've witnessed $25,000 replacement costs shock unprepared buyers. Thermal imaging cameras now detect insulation gaps and moisture intrusion invisible to the naked eye - insist on this technology during inspections.

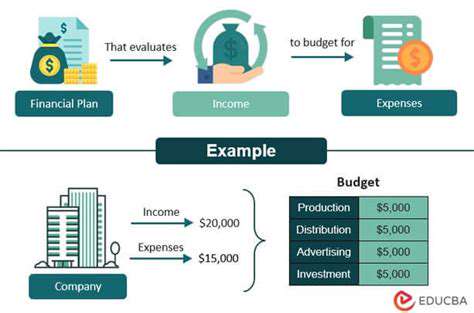

4. Financial Planning Essentials

Comprehensive Budget Mapping

Consider All Potential Expenses like emergency repair reserves. The 1% rule suggests setting aside 1% of home value annually for maintenance. For a $500,000 property, that's $5,000 yearly - can your budget absorb that?

Loan Product Navigation

First-time buyers often overlook physician loans or energy-efficient mortgages. Credit union rates frequently undercut big banks by 0.5-1% - it pays to shop around. Consider mortgage recasting if you receive unexpected funds - it lowers payments without refinancing costs.

5. Value Appreciation Factors

Demand Forecasting Techniques

Track where corporations are expanding - Amazon's HQ2 search caused Virginia home values to skyrocket pre-announcement. Future resale value depends on emerging trends like electric vehicle charging stations becoming standard expectations.

Community Evolution Patterns

Gentrification signals include craft breweries and yoga studios replacing pawn shops. However, rapid upscaling can price out essential services - balance trendiness with practical infrastructure.

Renovation ROI Focus

Kitchen remodels yield 72% ROI nationally, but only 54% in luxury markets. Consult local realtors before upgrading - their market knowledge prevents over-improvement losses.